Ahead of the planned strikes on Wednesday I thought I’d post a few thoughts on public sector pensions. I think of myself as being one of the few people that aren’t firmly on one side of the argument on this. I’m a taxpayer on one hand but defender of defined benefit pensions on the other. I’m therefore hoping that this post will perhaps dispel some of the various mistruths out there and perhaps get to the heart of the real dispute.

Why should the government provide good pensions to the public sector?

This seems a reasonable place to start in the debate. There are many shouting that they are too generous but is this just envy? The government should look to provide good pensions to those in the public sector for several reasons:

- It is reasonable for a government to be paternal and want to look after the workforce in old age.

- The government should lead by example, how can it expect others to provide if it doesn’t?

- It reduces potential costs in means tested benefits.

- Most importantly, it has a comparative example in doing so.

The government is much more able to take on the risk of defined benefit pensions than any other organisation. It can also provide them in a large scale efficient unfunded manner and is not subject to the horrendous number of legislative hoops that are in place for the private sector.

What is being provided? Isn’t it a gold plated benefit?

Public sector schemes generally provide benefits of either 1/80th of final salary for each year worked as a pension plus 3/80ths of final salary for each year worked as a lump sum OR 1/60th of final salary for each year worked as a pension. These benefits are generally payable at 60 or 65 with the majority currently still being payable at 60.

For example, if you joined at age 20 then retired at 60 you might get a pension of 40/80=half of your final salary plus a tax free cash sum of 1.5 times your final salary or, alternatively, a pension of 40/60=two thirds of your final salary but no lump sum.

Some schemes such as the police and armed forces are significantly different to reflect the nature of their roles.

Is this gold plated? Mostly it’s the same as what the private sector used to provide so arguably it’s not. However, retirement at age 60 without reduction is something that is very rare to see in the private sector and has been for some time. Arguably therefore the retirement age is the only thing that makes these schemes gold plated. It is often argued that the average pension is only £4,000 a year so how can they possibly be gold plated. The average pension is irrelevant. All it tells you is that there are quite a lot of low paid workers, quite a lot of part-time workers and quite a lot of people who don’t spend their entire career in the public sector.

What do these pensions cost?

Putting a value or cost on pensions is very difficult and there is no area in the pensions world that suffers quite as much in terms of bad calculations of cost as public sector pensions.

The “problem” with public sector pensions is that the majority of them are not funded. This means that the contributions paid just go to the treasury along with taxes raised and pensions are paid each year out of this pot as they fall due. This is instead of a funded scheme, which is the norm in the private sector, where contributions are paid into a pot that is invested and topped up as appropriate and pensions then paid out from this pot.

This “problem” leads to some horribly bad numbers being produced on the cost of public sector pensions.

The first is that the cost is often given as the pension outgo this year less contribution income this year. This tells us very little if anything about “cost”. If this was how we calculated cost then it would be more expensive to remove all public sector pension accrual than doubling their benefit accruals as the contribution income would fall to zero if accrual ceased.

The other awful number often quoted is when an attempt is made to “capitalise” into one number all future public sector pension promises. As it is an unfunded scheme this number is utterly meaningless. It’s as silly a number as putting a single figure on what we will spend on healthcare in the next 80 years! However, it is made even more meaningless by assuming that, if it were funded, the money would be invested in government debt i.e. the government would issue debt only to buy it back and that therefore the way to value the benefits is by using index linked gilt yields – nonsense!

Of course cost is also very difficult in the private sector. The problem with pensions in general is that they are paid a long time into the future, a future we know nothing about. Because of this, to determine the cost of benefits accruing we need to use a discount factor so that we can compare the value of money today vs money tomorrow.

Up until now this has been done for public sector pensions in the same way as would be done when evaluating any government capital project (e.g. building a bridge) by using a Social Time Preference Rate or, more specifically for pensions, the SCAPE (Superannuation Contributions Adjusted for Past Experience) approach (see here appendix D for more on this). This is a real (i.e. above inflation) discount rate of 3.5% pa. Following the Hutton Review it has been agreed to use a rate in line with expected economic growth agreed at 2% pa real. This drop in discount rate leads to a significant increase in the perceived cost of public sector pensions (see below).

In the private sector there are a myriad of different approaches used but the 3 main approaches are that: the actual expected cost is determined using rates in line with the expected return on the assets held; the funding cost is determined using a prudent expectation of the return on the assets held; and the accounting cost is determined using a corporate bond yield.

When considering the private sector we should also include defined contribution (DC) schemes as the majority of private sector pensions are now DC. A DC scheme being little more than a tax advantaged savings scheme with strings attached. In determining the cost to an individual of replicating a DB pension in one of these schemes we can again use the expected return on the assets likely to be held but also need to factor in the fact that they will need to buy an annuity from an insurer at retirement.

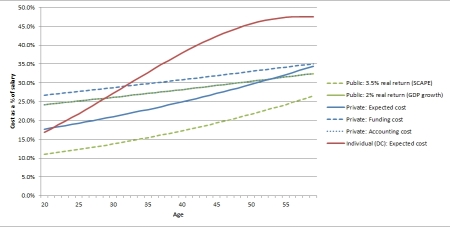

The chart below shows an approximate comparison of the cost as a percentage of salary of providing a pension of 1/60th of final salary payable from age 60 in the public sector and private sector (including an individual in the form of a DC scheme). It allows for above RPI inflation salary rises of 1% pa, CPI inflation increases in payment and makes many other assumptions (available on request) – it is not designed to be definitive. It does however potentially under rather than overstate the private sector costs (particularly at the moment with bond yields so low).

[Click to see a larger version]

The chart clearly shows the “comparative advantage” I mentioned earlier that the government had over the private sector in providing pensions with the SCAPE method discount rate. However, it also shows that this has largely been eroded when compared with private sector DB with the discount rate change. Finally, it shows where the problems stem from as the costs, on a DC basis which is the setup of most private sector schemes now, are substantially higher. This is an even bigger problem because the contributions being made to DC schemes are substantially less than were/are made to DB schemes. Workers in the private sector doing similar jobs to public sector counterparts on similar salaries are therefore looking across with some envy about where they perceive their taxes are being spent.

The change in public sector discount rate will increase the cost of benefits by around 50%! But private sector funding costs in the short term are around 10% higher still and for an individual in DC the cost is about 25% higher on average. When people talk about pension apartheid this is what they mean.

What’s proposed to change?

Very broadly:

- Contributions are to increase by 3% (but with little or no impact on lower earners)

- The accrual rate will be set at 60ths

- The new scheme will be based on average salary earned increased by average national earnings rather than final salary

- Retirement age will be linked to state pension age (65-68 depending on date of birth) rather than 60

However, a transition period is to apply such that those within 10 years of retirement at April 2012 will not be impacted and those within 14 years will have a lesser impact.

Additionally, this is a cost envelope only and benefits can be amended for each scheme provided the revised benefit is no more costly.

Why is this happening?

There is much talk about fair and sustainable pensions. Both fair and sustainable are pretty difficult concepts though when it comes to pensions.

I think there are 3 points to address separately about why this is happening: the contributions rise, the benefit changes and the transition period.

Transition

I’ll deal with the latter of these first as it’s easiest. The transition has been offered as members do not understand the proposed reforms/how they will operate and the government has inadequately communicated this. In my eyes they’ve taken something that had an automatic in built simple transition and suggested a complicated “transition” that has introduced potential cliff edges.

So if you are due to retire before 1 April 2022 you no longer need to worry about your benefits provided agreement is reached before the year end and the deal isn’t revoked. (So no need to strike!)

Even if the transition weren’t in place if you only had e.g. 5 years until retirement then you will only have 5 years on the new benefit structure. Your old benefits would be protected on the old structure! For example if the new benefits were worth 20% less (not necessarily the case) and you already have 20 years service then you’d still get 96% of your original entitlement. If you are 1 year away then you’d get 99% and 10 years away 93%. Automatic transition!

Conclusion: The transition period offered is a bad idea and the money would be better spent elsewhere.

Benefit changes

When considering sustainability we need to note that the current benefits are sustainable – particularly as “cap and share” that was introduced following the last set of changes means members could expect to have to increase contributions in the future if the cost rose. However, what we really mean when we talk about sustainability is what level of benefit are we prepared to sustain?

What do we mean by fairness? Well the definition being applied seems to have 2 parts attached to it. Firstly that for it to be fair the changes should have greater impact on the higher rather than lower paid and secondly that pension benefits accruing should be fair to the tax payer. The first aim is I think achieved by the career average structure which for a given total cost should ensure greater benefits for the lower paid who generally don’t have such high salary growth. The second is much more subjective but it’s worth referring to notes on costs above noting just because it costs the government less doesn’t mean it should provide more as it should be using the comparative advantage to reduce costs.

One point that has clear sustainability merits is linking retirement age to state pension age as this should help ensure stability of cost going forward. I think it’s also reasonable to suggest that taxpayers aren’t getting the best value out of providing pension benefits as they stand. The number of opt outs suggested due to contribution rises shows that member value is nowhere near as high as cost on any measure. This is partly due to the mistrust members have with pensions and governments.

Conclusion: much of what is proposed is perfectly reasonable but much work needs to be done on communicating the value of benefits to members.

Contribution rises

There is an element in this that is about fairness and attempting to address the fact that the perceived total reward in the public sector is too high. Increasing member contributions has the effect of addressing the balance without talking about salary cuts. By ensuring the lower paid are affected less, the approach to increasing contributions is also arguably fair. However, I get the feeling that the increase in contributions is probably the overwhelming problem with the proposed reforms. This is the one that hits members pockets directly today and, assuming the government does want to encourage membership, is exactly the same as a pay cut.

However, we are in a financial black hole. As well as being the only thing that hits member’s pockets today, it’s also the only think that provides extra income to the government today. This is why it is being done. The contribution rises have very little to do with fairness and sustainability but everything to do with the deficit that exists in public finances. There is nothing wrong with this but it needs to be communicated as such.

Higher contributions or lower salaries

or

Higher contributions or redundancies

If the contribution rise doesn’t go ahead then the finances need to be filled by something else. This is why this area of change is not negotiable. This message has not been communicated though.

Conclusion: it’s going to happen but needs to be communicated why.

Other points of note

- Just because your normal retirement age is 68 doesn’t mean that’s when you have to retire.

- After the changes public sector schemes will still be very good and the envy of private sector workers.

- We need to think hard about our ageing workforce. Some jobs just can’t be done at 68. Is it time to introduce positive age discrimination to get older workers into jobs they can do?

- We need to attack things from the other angle and remove the barriers to private provision so that DB schemes can once again exist for private sector workers – much of the problem is due to bad regulation.

Thank you – very useful to get more detail rather than the radio slagging matches.

I understand that there are 101 Local Government Pension Schemes – UNISON made a substantial submission to Hutton concerning the LGPS, proposing that a strong case could be made for reducing the contributions rise…..by merging the individual funds.

Other unions made similar proposals. UNISON’s submission is well written and researched the Dutch APG has independently verified the £ merger benefits that UNISON claim. They found that had the funds been merged into 14 regional funds, over the period 2001-09, then each LGPS member (contributing, deferred and retired) would be better off by £275 p.a. That works out at c. £990m p.a.

It is evident that the £ benefit of merging the funds should be significant ( perhaps £300m – £400m pa), and would have a material impact vis-à-vis the £900m p.a. saving that the Gov’t is looking for by 2015 (as either £450m from contribution hikes and £450m from accrual rate changes, or £300m from more contributions and £600m from rate changes).

Such a move would provide several important benefits, notably the well accepted benefits of ”scaling up” pension schemes (economies of scale, clout when dealing with the industry on dealing costs, including commission, improved governance, better quality advice, etc.).

It would also be a hugely valuable source of common ground between unions and Gov’t / taxpayers. Such common purpose is rare and should be used for relationship building to help overcome greater challenges within the negotiations.

Thanks David and completely agree.